vanguard tax exempt bond etf review

An example would be QQQ and the inverse PSQ as a possible strategy. Designed to track the performance of a broad index of taxable investment-grade bonds it excludes tax-exempt bonds such as bonds issued by state governments and municipalities and inflation-protected bonds Treasury Inflation-Protected Securities.

Vanguard Tax Exempt Bond Etf Experiences Big Outflow Nasdaq

A high correlation between funds may mean that your portfolio of funds is not as diverse as you might want it to be.

. The two we like have five-star Morningstar ratings and charge only 009 expenses. Moreover because the fund. The Vanguard Total Bond Market ETF BND is VTIs bond market equivalent.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services we. For some investors a portion of the funds income may be subject to state and local taxes as well as to the federal Alternative Minimum Tax. As of 04302021.

Regardless of what the markets do you will end up with a loss that is actually. As of 10312021. Long-Term Bond Index FundInstitutional Plus Shares VBLIX 050.

As of 12312021. Savings bonds are exempt from state or local taxes but interest earnings are subject to federal income. The purpose of fixed-income investments is to add diversification to a portfolio says Rich Powers Head of ETF Product Management at Vanguard.

1 Vanguard High Yield Tax-Exempt Admiral Fund VWALX that requires a minimum of 50000. Compare all the. Long-Term Bond Index FundAdmiral Shares VBLAX 050.

There is not one. As of 04302021. Total Stock Market ETF.

It invests in investment-grade municipal bonds of short- intermediate- and long-term issues. As of 04302021. As of 08312021.

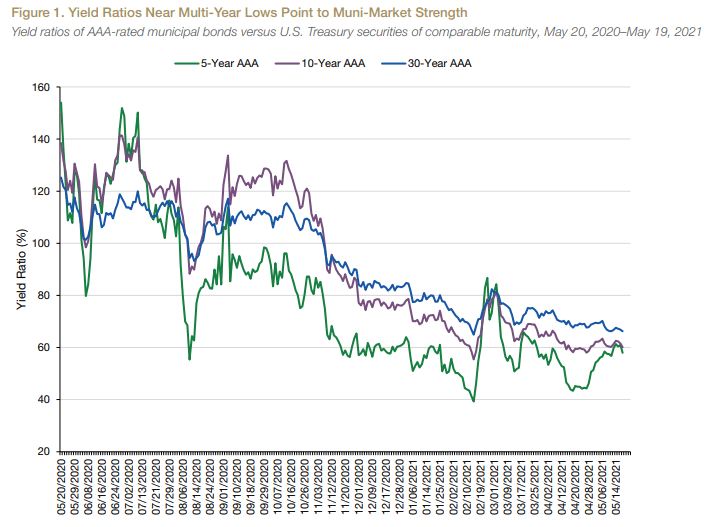

2 Bond ETFs are similar to bond mutual funds in that both. A municipal bond yielding 2 is the equivalent of 3. If youre a high-income earner look specifically at municipal money market.

Especially if you dont need those funds immediately Clark advocates for Vanguards short-term bond index funds. While other tools may compare funds only to the SP 500 or 500 Index fund you can use this tool to determine how closely the performance of one Vanguard stock fund tracks that of any other Vanguard stock fund. Its important to compare after-tax yields between a municipal bond and a comparable taxable bond to find out which offers a higher return.

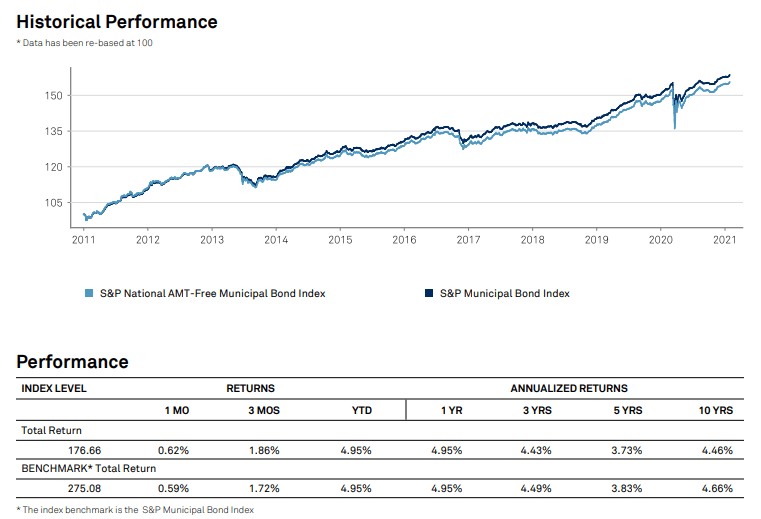

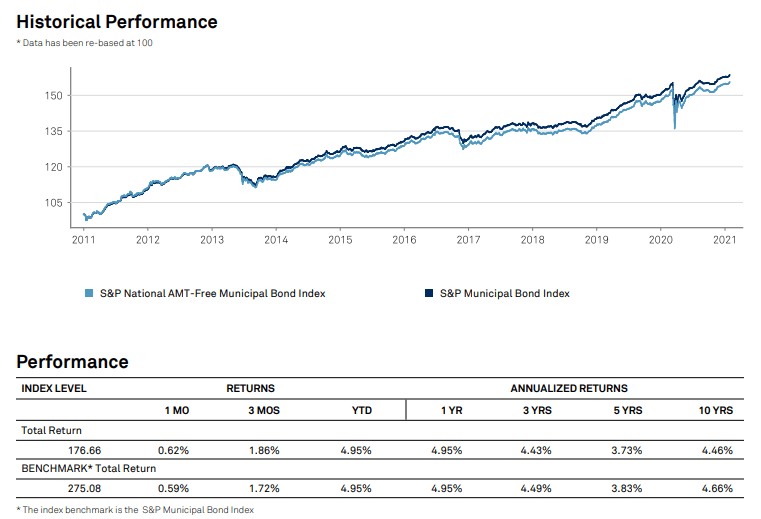

Total Intl Stock ETF. It has a one-year yield of 105 and a 10-year yield of 56. Vanguard Tax-Exempt Bond Index Fund Admiral Shares VTEAX This index fund provides broad exposure to US.

The minimum purchase amount is 25 while the maximum purchase per calendar year is 10000. Here are three leading muni bond ETFs. The countrys finance minister Arkhom Termpittayapaisith said the new rules were developed to promote the nascent digital asset.

Total Stock Market ETF. Provides gives investors broad exposure to the taxable investment-grade. Tot Intl Bond ETF.

These funds will either produce few dividends or little interest or income that may be partially or fully exempt from taxes such as municipal bond interest. As of 06302021. Fortunately Vanguard has solid tax advantaged Admiral funds that we are planning to purchase.

Bond funds up close. Thailands revised tax policy also allows traders to offset their annual losses against gains when filing their crypto investment taxes. Tot Intl Bond ETF.

The Vanguard Total Bond Market ETF was designed to provide highly diversified exposure to the US-dollar-denominated bond market. The Vanguard Total Bond Market ETF tracks the Bloomberg US. Nuveen Tax Exempt Conservative Income MAPS Nuveen Tax Exempt Moderate Income MAPS Nuveen Tax Exempt High Yield MAPS PIMCO Capital Preservation MAPS PIMCO Enhanced Core MAPS PIMCO Income Focus MAPS Siegel WisdomTree Longevity Model MAPS Siegal WisdomTree Global Equity Model MAPS Mar Vista Investment Partners LLC Strategic Growth.

Try to avoid holding high-yield ETFs in a regular brokerage account. As of 10312021. Like the underlying debt instruments they hold these ETFs are tax-exempt which can be highly beneficial to investors in high-income tax brackets.

Total Corporate Bond ETF. Simply put if you owe the IRS 1000 but qualify for a 1000 tax credit that 1000 tax liability is wiped out. Some of the most widely held ETFs in this category also include iShares 1-3 Year Treasury Bond ETF SHY and Vanguard Short-Term.

Although the income from a municipal bond fund is exempt from federal tax you may owe taxes on any capital gains realized through the funds trading or through your own redemption of shares. I am wondering if it might be possible to manufacture a tax loss for a given year by purchasing an index ETF and the inverse of that ETF. They seem to track each other without a lot of decay unlike some of the 2x and 3x products.

While bond mutual funds have been around longer bond ETFs are growing in popularity. Wiener is editor of The Independent Adviser for Vanguard Investors a monthly newsletter that keeps abreast of recent developments at Vanguard and the annual FFSA Independent Guide to the Vanguard FundsThrough his newsletter and guide book Dan helps tens of thousands of Vanguard. As of 10312021.

Aggregate Float Adjusted Index a broad market-weighted index. Total Bond Market ETF. Total Corporate Bond ETF.

Total Bond Market ETF. Tax-Exempt Bond Index Fund Admiral Shares VTEAX None. Vanguards money market funds are also a good alternative to stashing your emergency fund in a savings account at an online bank or credit union.

Long-Term Bond Index FundInstitutional Shares VBLLX 050. These new regulations and exemptions will come into full effect from April and will last until December 2023. Since the first US-listed bond ETF was launched in 2002 bond ETFs have accumulated over 800 billion in assetsalthough that is still a fraction of the roughly 36 trillion bond mutual fund market.

You should have a diverse mix of ETFs in your retirement accounts. Americas leading expert on investing in Vanguard funds Daniel P. As of 02282021.

Due to the assets held in the fund it is known for producing high levels of income compared to other bond funds. The best exchange-traded funds. A tax credit is a dollar-for-dollar reduction of your tax liability.

Total Intl Stock ETF. However the fund does not invest in inflation-protected bonds or tax-exempt bonds. Best ETFs for a Roth IRA.

The Best Performing Bond Etfs How To Find Them Nasdaq

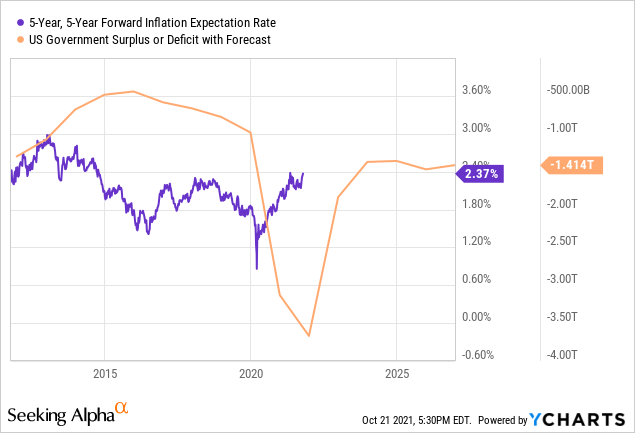

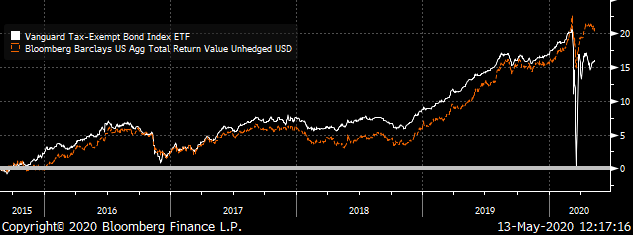

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

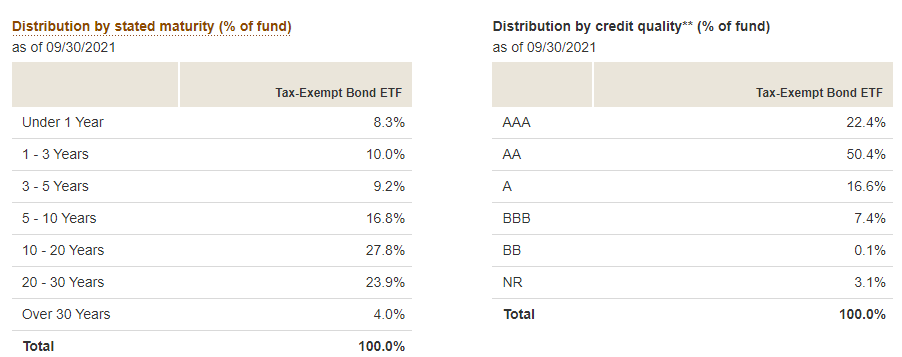

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

The Best Performing Bond Etfs How To Find Them Nasdaq

Vanguard Tax Exempt Bond Vteb Enters Oversold Territory Nasdaq

Vteb Vanguard Tax Exempt Bond Etf Provides 2 Yield With Less Interest Rate Risk Than Many Bond Funds Nysearca Vteb Seeking Alpha

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Mub Ishares National Muni Bond Etf Etf Quote Cnnmoney Com

Vteb Vanguard Tax Exempt Bond Etf Dividend History Dividend Channel

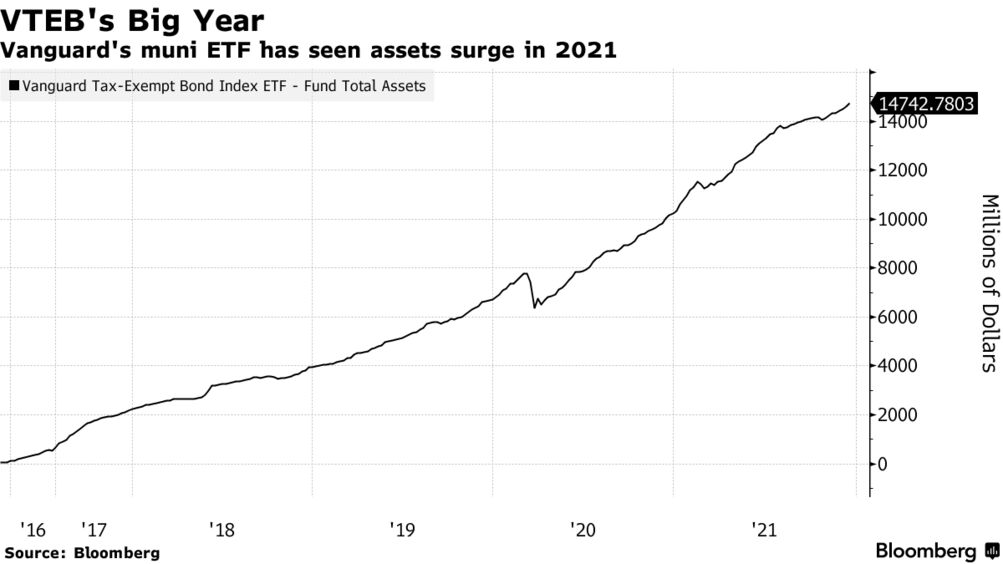

Muni Etfs Grow Fast As Yield Starved Investors Seek Cheap Funds Bloomberg

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

The Best Performing Bond Etfs How To Find Them Nasdaq

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vteb Vanguard Tax Exempt Bond Index Fund Etf Shares Etf Quote Cnnmoney Com

The Best Performing Bond Etfs How To Find Them Ycharts

Vanguard Tax Exempt Bond Etf Vteb Stock Price News Info The Motley Fool

6 Vanguard Etfs To Build A Better Portfolio Vym Vgt Vpu Investorplace